Optimize the processing of corporate lending

A scalable and cost effective service that allow you to become more agile, add new loan products and services, and provide customers with an exceptional experience.

Optimize the processing of corporate lending

Our loan processing platform is a scalable and cost effective service that allow you to become more agile, add new loan products and services, and provide customers with an exceptional experience.

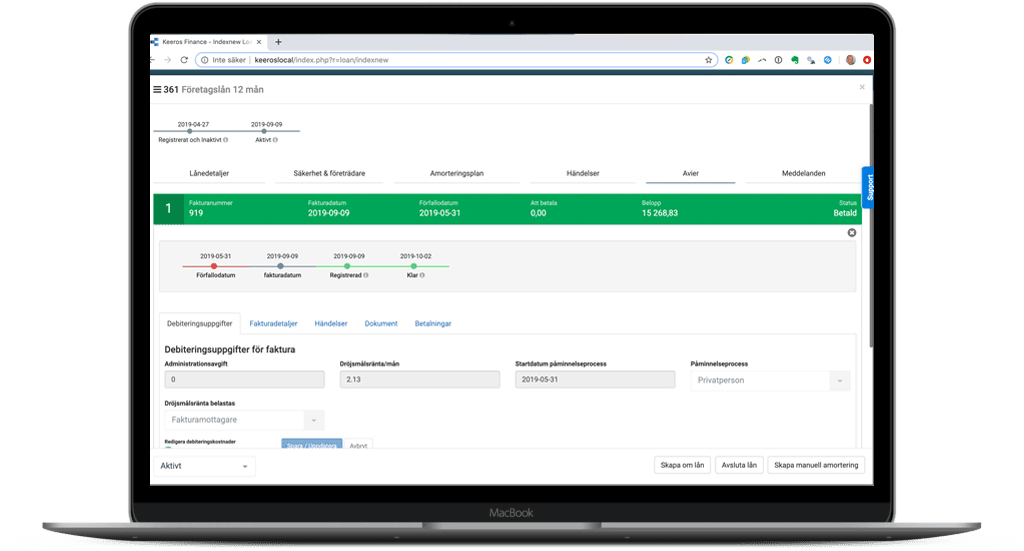

Easy to Use

Our user-friendly interface simplifies loan creation and management with credit assessments, loan calculations, and real-time reporting. Say goodbye to loan management stress and choose our intuitive platform for a seamless experience.

On-boarding och KYC

Our integrated decision engine verifies incoming loan applications, providing the basis for quick and accurate credit decisions. Plus, with BankID and secure messaging, we ensure customer identity is verified and credit decisions are fully documented.

Payment monitoring

Our system automatically generates payment notices for your approval and printing, ensuring compliance with your set process. Whether it's through reminders or forwarding outstanding debt to KFM, we take the right action when payments are due.

Client login and API

Our "My Pages" module offers customers a secure way to log in with BankID and manage their engagement. Our open APIs allow for secure exchange of information with external partners, including automated printing and distribution, bank file management, and legal signatory verification.

High security

Our secure loan system features traceable actions and advanced authorization models, with automatic logging of secure messaging and events. To prevent fraud, we support blocking of bank accounts, social security numbers, and IP addresses, and can work with credit institution credit templates.

Flexible loans and payment plans

Our service offers a range of flexible loan options, allowing you to create unique payment plans and products for your customers. You can choose from traditional annuity and straight-line amortization loans, with the ability to customize setup and invoice fees to fit your specific needs.

Ready to get started?Book a demo today.

We help you get started in no time. Book a demo today and get an overview of how we can help you streamline your business.

Our Loan Products

Flexible loan options for your needs

Our loan platform is designed to meet your specific needs in business financing. You can read about some of our loan products here beside. We can also tailor loan products according to your needs and create what we call hybrid products.

- Business Loan

- Traditional business loans with amortization and interest. The loan can be secured or unsecured and can have a fixed or variable interest rate.

- Contract Financing

- Contract financing is a type of loan used to finance a contract that runs for a certain period of time, and where the contract is continuously invoiced using our notification module.

- Issuer Loan

- An issuer loan is a loan given to a client who also sells their invoices to you. The loan is amortized by offsetting amortization against incoming invoices.

- Inventory Financing

- Inventory financing is offered to customers who temporarily need to finance the buildup of physical or virtual inventory.

Boost Your Business: Easy and Secure Loan Processing Solution

Revolutionize your corporate lending operations with our seamless, secure, and scalable loan processing service. Embrace agility, expand your product offerings, and deliver an exceptional customer experience.